Iran war pushes oil price above $90, threatening rise in global inflation

The Iran conflict has driven the oil price past $90 a barrel to its highest weekly gains since the Covid-19 pandemic six years ago, threatening a fresh rise in global inflation.Reports that Kuwait had begun cutting production of oil at some fields after running out of space to store it drove the cost of a barrel of Brent crude to as high as $91.89 at one point on Friday – its highest since April 2024 and up from about $72.50 just before war broke out.The price of the international benchmark has surged by more than 25% since the US-Israel attack on Iran last weekend, its biggest weekly jump since the week to 3 April 2020

North Korean agents using AI to trick western firms into hiring them, Microsoft says

Fake IT workers deployed by North Korea are using AI technology, including voice-changing tools, to trick western companies into hiring them, Microsoft has said.The US tech firm said a signature Pyongyang money-raising ruse is being enhanced by AI, which is helping create fake names and alter stolen IDs to increase the credibility of false applicants for IT and software development jobs.The scam typically involves state-backed fraudsters applying for remote IT work in the west, using fake identities and the help of “facilitators” in the country where the company targeted is based. Once hired, they send their wages back to Kim Jong-un’s state and have even been known to threaten to release sensitive company data after being fired.According to a blogpost from Microsoft’s threat intelligence unit, Pyongyang is using AI to bolster the effectiveness of its ploy

Brent crude hits $90 as Kuwait ‘starts cutting oil production’; shock as US economy loses 92,000 jobs in February – as it happened

The UK stock market has recorded its biggest weekly fall in eleven months, as the Middle East crisis has hit shares.The FTSE 100 share index has closed 129 points lower today at 10,284, a drop of 1.24% during today’s session.That means it has lost 5.75% of its value since the start of this week, its worst performance since the week to 4 April 2025, when Donald Trump’s “Liberation Day” tariffs rocked markets

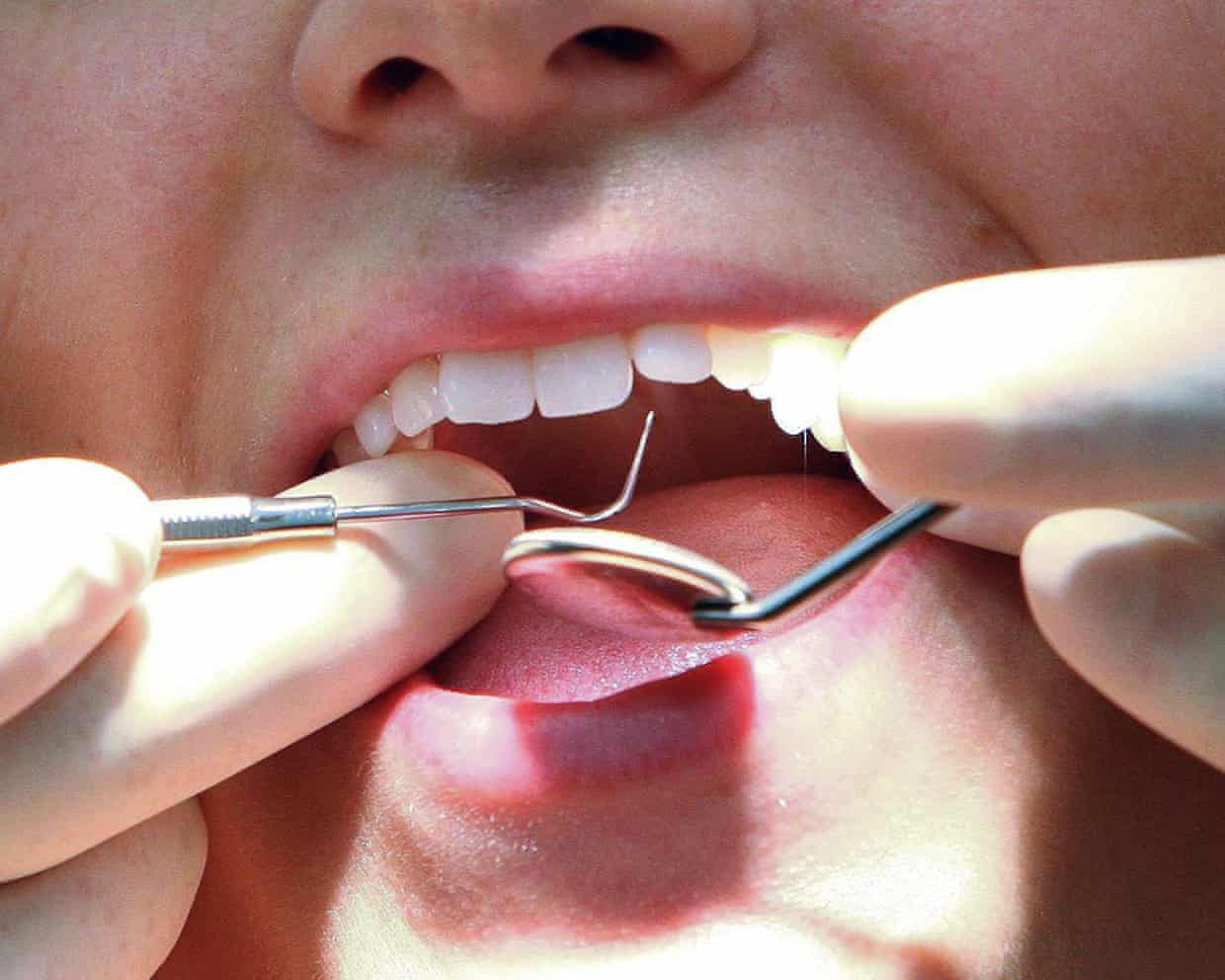

Royal Mail criticised as first-class stamp price rises to £1.80 despite ‘failing service’

Royal Mail has been criticised for announcing another hike in the cost of first- and second-class stamps while providing what Citizens Advice described as a “failing service”.From 7 April, the price of a first-class stamp will increase by 10p, or 6%, to £1.80. The cost of the second-class service is going up by 4p, or 5%, to 91p. Royal Mail blamed the need for price increases on the “continued rise in the cost of delivery for every letter”

US lost 92,000 jobs in February just before Trump joined Iran conflict

The US lost 92,000 jobs in February, an unexpected major slackening in the labor market that came just before Donald Trump threw the global economy into upheaval with his conflict in Iran.The unemployment rate edged up to 4.4% in February. In comparison, the US added a revised 126,000 jobs in January, far surpassing expectations of 70,000 jobs but still less than January 2025. Economists predicted an increase of 60,000 jobs added in February and a steady unemployment rate of 4

BP’s new boss will take home at least £11.7m this year, more than double her predecessor

The incoming chief executive of BP will take home at least £11.7m this year after joining the embattled oil company from a rival, more than double the pay packet earned by her predecessor.Meg O’Neill will join BP from the Australian oil company Woodside Energy in April as the company’s first external hire to its top job, and the first woman to serve as chief executive at the 117-year-old oil major.The former ExxonMobil executive will earn a base salary of £1.6m, narrowly above the salary paid to her predecessor, Murray Auchincloss, but the bulk of her pay packet will be payments made by BP to compensate O’Neill for the share awards she was in line to receive over the next five years in her previous role

Rail passengers warned over six-day Easter shutdown on west coast mainline

Rail passengers planning to travel over the Easter break face disrupted journeys owing to a six-day shutdown on Britain’s biggest intercity line.Engineering work means there will be no west coast mainline services between London Euston and Milton Keynes from Good Friday (3 April) to Wednesday 8 April.There will also be no service between Preston and Lancaster on the line on 4-5 April.Network Rail said the work, which is part of a £400m project to increase the reliability of the line, was vital and that bank holidays were chosen for such works because they were among the least busy times to close.“The four-day period at Easter gives us a valuable opportunity to complete projects that simply can’t be delivered during a normal weekend,” said Jake Kelly, the body’s regional director for the north-west and central region

‘We’re powerless … and hoping nothing hits us’: trapped on a tanker as Iran war escalates

Thousands of seafarers are trapped on tankers in the Gulf after the strait of Hormuz was effectively closed to shipping by the escalating war on Iran.The Guardian spoke to a crew member on one of the stranded tankers that typically ferries vast quantities of oil from the Middle East to ports around the world.“When [Donald] Trump said Iran had 10 days to agree to his deal or bad things would happen, I did the math and thought we might get stuck here. And we did,” said the seafarer.From a cabin below deck, they explained how the crew watched explosions light up the sky as they loaded the vessel with crude oil at an industrial complex in the Gulf

US grants waiver to allow India to buy Russian oil amid Iran war

The US has temporarily allowed India to buy Russian oil currently stuck at sea in an effort to keep global supplies flowing and temper further price increases.The US treasury has issued a 30-day waiver allowing India to buy Russian oil, having previously imposed heavy sanctions related to the war in Ukraine.“To enable oil to keep flowing into the global market, the treasury department is issuing a temporary 30-day waiver to allow Indian refiners to purchase Russian oil,” the treasury secretary, Scott Bessent, said in a statement posted to social media on Thursday. “This stopgap measure will alleviate pressure caused by Iran’s attempt to take global energy hostage.”In August the US president, Donald Trump, imposed an additional 25% import tariff on India over its purchase of cheap Russian oil, arguing that New Delhi’s purchases were undermining US sanctions and helpingVladimir Putin bankroll the invasion of Ukraine

‘Geopolitical uncertainties’ amid Iran war could slow fall in mortgage rates, says Halifax

Halifax has warned that the US-Israel war on Iran could slow mortgage rate decreases this year, as it said that house price growth eased dramatically in February.Halifax, which is part of Lloyds – Britain’s biggest mortgage lender – said the conflict in the Middle East was likely to affect global economies, stoke inflation and reduce the likely rate of interest rate cuts that influence borrowing costs for homebuyers.The lender said the value of a typical UK home rose 0.3% in February to £301,151.However, this is a significant dip in the rate of growth compared with the 0

Water firms sent bailiffs to tens of thousands of homes for debts under £1,000

Tens of thousands of people a year have bailiffs sent to their homes by water companies in England and Wales, data shows.Many thousands of these visits by debt collectors were for sums worth under £1,000, according to the data released by the House of Commons environment, food and rural affairs (Efra) committee. Bailiffs are debt collectors instructed by a court, who can seize items from those in debt, including electrical items, jewellery or vehicles.It is a postcode lottery as to whether a water company would send a bailiff to a person’s home to recoup unpaid bills. While Wessex Water has not used bailiffs in 10 years, the water companies that made the most use of bailiffs in 2025 – adjusted for population – were South West Water, Southern Water and Yorkshire Water

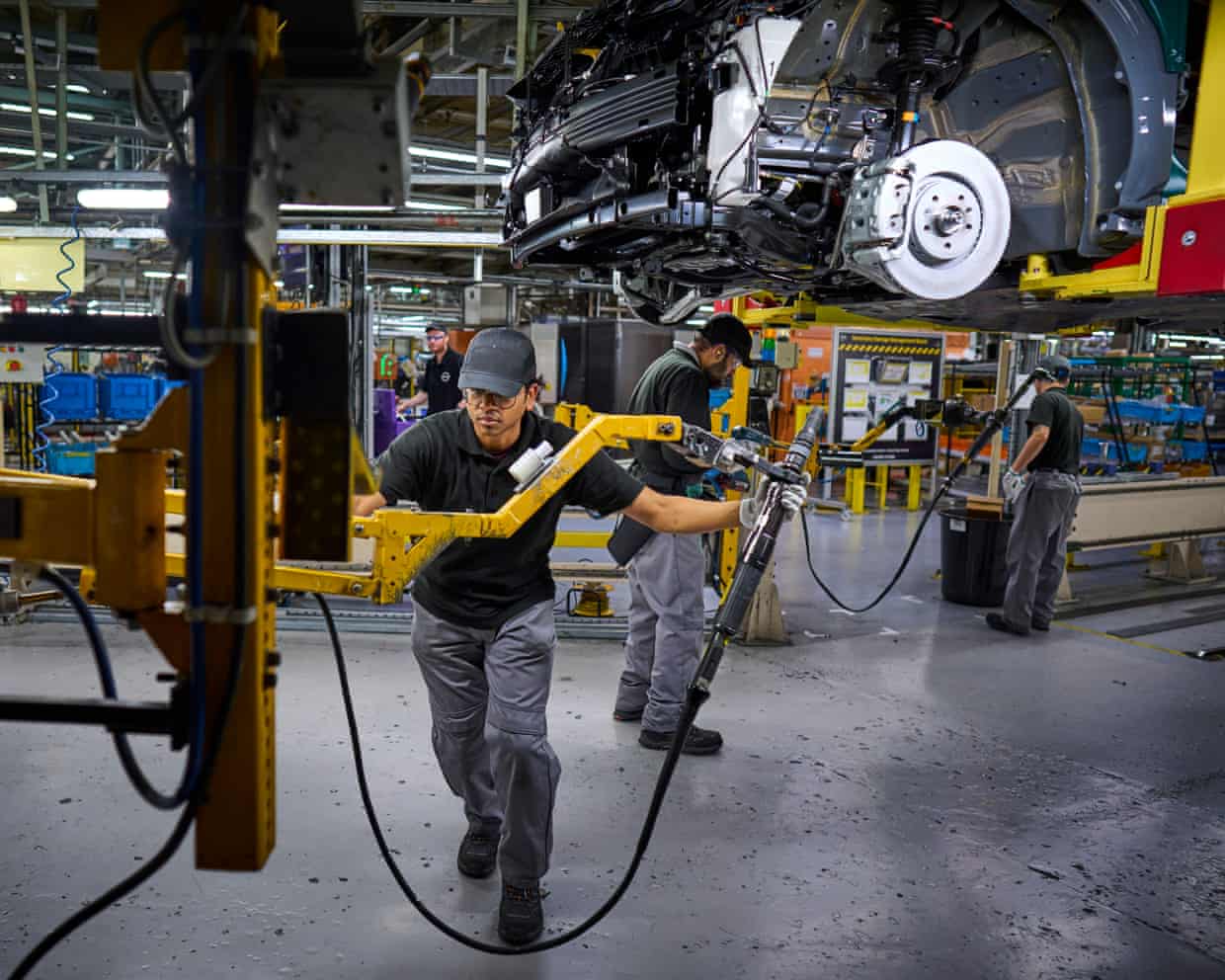

Nissan ‘says Sunderland plant could close’ if UK excluded from Made in Europe rules

The Japanese carmaker Nissan has reportedly said it could be forced to close its plant in Sunderland if the UK is not fully included in new “Made in Europe” manufacturing rules proposed by the EU.The UK car industry trade representative group also said it was “gravely concerned” about the proposals, which it said could damage the £70bn annual cross-channel trade.Under the EU plans, public subsidies to speed up the development of electric vehicles would only be available to EVs made in European plants. Announced by the EU industrial strategy commissioner, Stéphane Séjourné, on Wednesday, the proposed Industrial Accelerator Act (IAA) is designed to protect the bloc from cheap competition from China.According to reports on Thursday, Nissan has privately warned the UK government it could be forced to close if the proposals became law

Trump says he fired Anthropic ‘like dogs’ as Pentagon formally blacklists AI startup

Retailers want ‘delightfully human’ AI to do your shopping, but will the chatbots go rogue?

Google Pixel 10a review: cheaper Android is great, but no real advance

Sam Altman admits OpenAI can’t control Pentagon’s use of AI

Elon Musk takes witness stand in trial over Twitter takeover

Joy of teaching English in the age of AI | Letter

Union tries to seize control of works council at Tesla’s German factory

Europe’s next-generation fighter jet project may collapse if row continues, says warplane maker

Google faces lawsuit after Gemini chatbot allegedly instructed man to kill himself

X to ban users from earning revenue if they post unlabelled AI-generated war videos

Nvidia and UK Wealth Fund invest in British autonomous driving startup Oxa

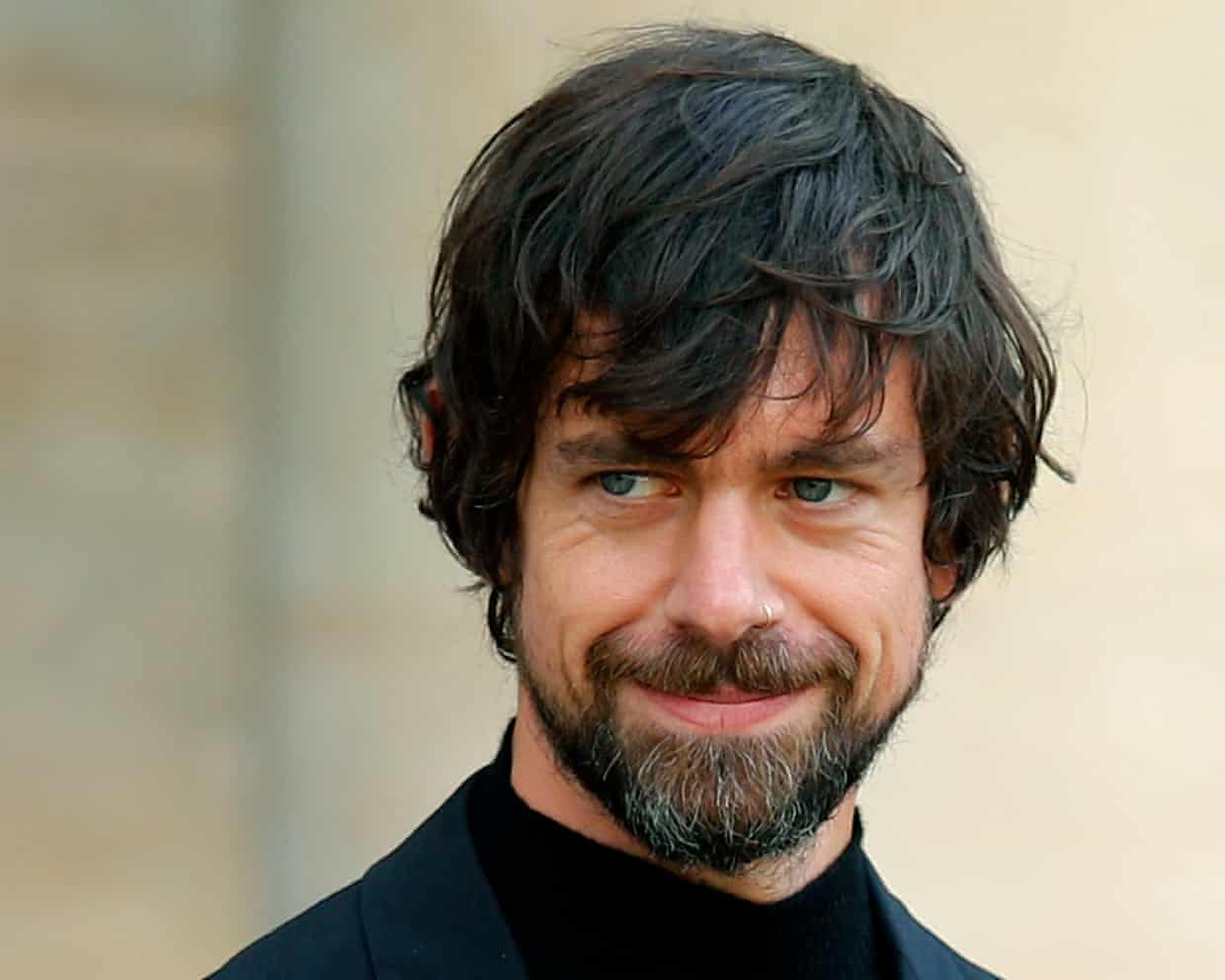

What was really behind Jack Dorsey laying off nearly half of Block’s staff?

Trump shouldn’t ease Russia sanctions – they are choking its economy

Donald Trump handed Vladimir Putin a financial lifeline last week when he waived a ban on India buying Russian oil for 30 days.Trump found himself in a furious row last year with Narendra Modi over his country’s oil deals with Moscow, only for fences to be partly mended when India’s biggest importer later capitulated.Now we find the power of oil as an instrument of geopolitical power is again to the fore. It suits the US president to ease up on sanctions against Russian oil purchases to keep the global oil price down.Trump knows that high prices at the pump could send his popularity to fresh lows and believes that allowing more Russian oil into the global system will limit the extent of an Iran-induced petrol price spike

Airline groundings expose depth of world travel’s reliance on Gulf corridor

After nearly a week of uncertainty, airspace closures and very limited flights, news that hundreds of thousands of passengers around the world were hanging on for emerged: the Gulf-based carrier Emirates was restarting operations in earnest despite the US-Israel war on Iran.Those relieved by the restart will include the UK’s Foreign Office, after its travails in organising delayed rescue flights out of neighbouring Oman.Emirates plans to return to 11 daily flights to five British airports by Saturday, and will operate to 60% of its full network, 83 destinations in all, including seven US airports and a total of 22 daily flights to India.Yet the partial return will struggle to dispel the doubts raised by a week when many started to wonder, just where will the world fly now?Before the crisis, the three big Gulf hubs – Dubai, home of Emirates, Abu Dhabi for Etihad and Qatar Airways’ Doha base – had established themselves as the crossroads of global aviation, with networks that link Asia, Africa, Europe and reaching out to the Americas and Oceania.Nearly 300,000 people pass through one of the three hubs every day and about two-thirds are heading straight through on a connecting flight

The Guardian view on AI in war: the Iran conflict shows that the paradigm shift has already begun

“Never in the future will we move as slow as we are moving now,” the UN secretary-general, António Guterres, warned this week, addressing the urgent need to shape the use of artificial intelligence. The speed of technological development – as well as geopolitical turbulence – is collapsing the distinction between theoretical arguments and real world events. A political row over the US military’s AI capabilities coincides with its unprecedented use in the Iran crisis.The AI company Anthropic insisted that it could not remove safeguards preventing the Department of Defense from using its technology for domestic mass surveillance or autonomous lethal weapons. The Pentagon said it had no interest in such uses – but that such decisions should not be made by companies

Ben Affleck sells his AI postproduction startup to Netflix

Ben Affleck has sold his artificial intelligence company to Netflix in a surprise deal, saying he had been driven to embrace a technology that had initially “really scared” him.Netflix has acquired the postproduction startup InterPositive from the Oscar-winning actor, director, producer and screenwriter for an undisclosed sum.Affleck had kept InterPositive below the radar and had previously played down AI’s creative abilities. This year, he told the podcaster Joe Rogan he did not think the technology would be able to “write anything meaningful” or make films “from whole cloth”.However, in a video announcing the transaction, the Good Will Hunting and Gone Girl actor said he had moved from being scared of AI’s potential impact when he first encountered the technology to viewing it as a “really meaningful innovation”

Make no mistake, this is now a full blown crisis for England and Borthwick | Gerard Meagher

The haunted look writ large across the face of Maro Itoje said it all. England had burst into the Italy half, deep into the 80th minute and Ollie Chessum was on the gallop, desperately trying to salvage something from the wreckage. Closer and closer they got before the shrill of the referee’s whistle confirmed England’s worst nightmare. Italy were about to put the seal on a first ever win in the fixture in 33 attempts and it was dawning on Itoje that he was powerless to stop it.The final whistle blew and England players were, to a man, stunned

Gregor Townsend keeps his cool after Scotland topple France to stay in title hunt

Gregor Townsend remained ice cool after Scotland’s exhilarating seven-try victory against France, which keeps them in the hunt for the title with one round to play, a position Scotland have never known in the Six Nations. The win was no big deal, he seemed to be saying.“There have been other games where it’s probably meant a lot to the group,” he said, “whether it was a response or to break a record – away from home in Paris or Wales, or beating England for the first time in a number of years. So they maybe are the ones that have more significance. This [win] is very significant, but just now it’s round four

Labour accuses Badenoch of scoring ‘cheap political points’ over Iran strikes

Labour has accused Kemi Badenoch of scoring “cheap political points” after the Conservative party leader said Keir Starmer was “too scared” to join strikes on Iran.Al Carns, the defence minister, said “serious politics” was required in response to Badenoch’s speech at the party’s spring conference where she criticised the prime minister’s stance on the US-Israel strikes on Iran a week ago.Initially, Starmer did not allow the US to use UK RAF bases for the attack, and did not take part in initial military action against Iran, but then said the RAF would take part in defensive operations. A strike by an Iranian drone hit an aircraft hangar at RAF Akrotiri in Cyprus.Badenoch told the Conservative’s spring conference in Harrogate, North Yorkshire: “At a time when Britain needs strong and decisive leadership, we have a prime minister who is too afraid of making the wrong decision, too afraid to make any decision at all

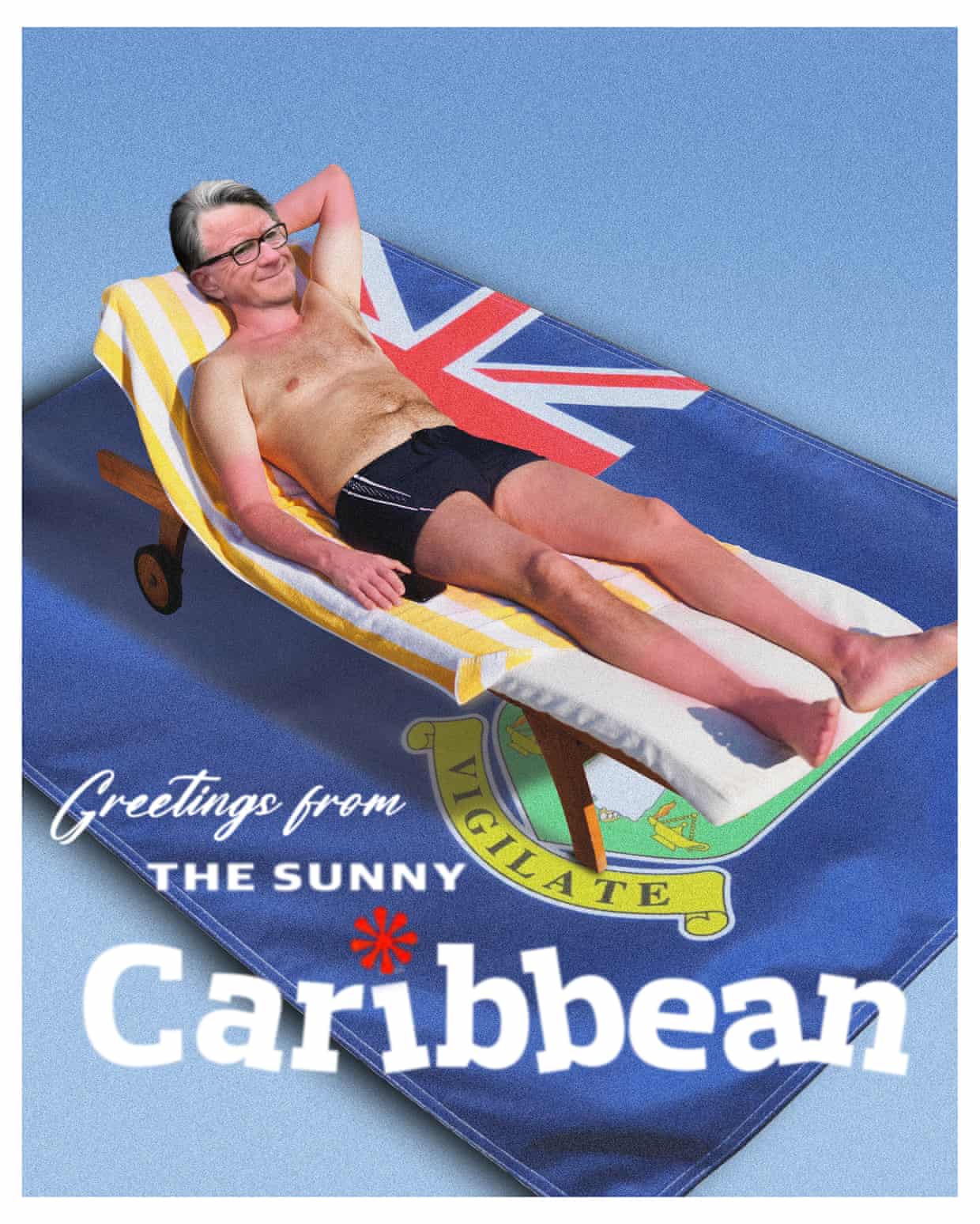

‘Like fleeing to Southampton’: was Mandelson escape ‘plot’ just a joke?

Is it really plausible that Peter Mandelson could have hatched a daring plot to escape to the British Virgin Islands? In the capital of Road Town for the last week or so, the question has been on many minds. And even if the UK’s Commons speaker, Lindsay Hoyle, came away with that possibility in mind from a recent visit, very few of them are convinced.“It seemed strange to me,” said one bemused local official who had met Hoyle at a function a few days earlier, “that if you were going to flee, it would be to a British territory. From a logical point of view, you’re still more or less in the UK. It’s like fleeing to Southampton

Has dinner been served with a side of romance? | Brief letters

I can’t be the only person wondering if Dining across the divide (1 March) is possibly resulting in more romantic liaisons than Blind date? Some of them are heartwarming.Ed ClarkeManchester Why all the excitement about a cricket ground within the boundaries of a World Heritage Site (Letters, 27 February)? Derwent Valley Mills has five (viz Cromford Meadows, Ambergate, Belper Meadows, Duffield Meadows and Darley Abbey).Paul EnglishBelper, Derbyshire My anorak has a “funnel” neck (Hiding in plain sight: everyone from Meghan to the Beckhams wants a funnel neck, 27 February). Fortunately, it doesn’t allow rain to cascade through it.Theresa GrahamClevedon, Somerset I was surprised and pleased to see Felicity Cloake’s reference to Farmhouse Fare (How to make the perfect bara brith – recipe, 1 March)

Helen Goh’s recipe for lemon curd layer cake | The sweet spot

This is both simple and celebratory, which in my book makes it just right for Mother’s Day next weekend. It has a fine, tender crumb, which pairs beautifully with the soft, creamy tang of lemon mascarpone, and I use lemon curd in the batter (shop-bought for ease) to bring a particular smoothness and depth of lemon flavour. Finished with a little extra curd and a scattering of edible flowers, it is pretty and unfussy and will hopefully make your own mother’s day.Prep 5 min Cook 1 hr Serves 8-10330g plain flour 2½ tsp baking powder ½ tsp fine sea salt 225g room-temperature unsalted butter225g caster sugar Finely grated zest of 2 lemons 3 large eggs, at room temperature160g lemon curd 250ml whole milk Small edible flowers, to decorateFor the lemon mascarpone 250g lemon curd, plus extra to decorate250g mascarponeHeat the oven to 180C (160C fan)/350F/gas 4 and line the base and sides of two 20cm round cake tins with baking paper.Sift the flour, baking powder and salt into a medium bowl

‘Kitty karma’? Jessie Buckley tries to claw back approval after enraging cat-lovers

If Jessie Buckley fails to win the Oscar for best actress next week it will be a sign that cat lovers have got their claws out.The Irish actor is the runaway favourite for her performance in Hamnet, but in recent days has stumbled into a controversy over a stated antipathy to cats.She has said she once gave her husband an ultimatum to banish his two cats because they would defecate on pillows, telling a podcast: “I was like, ‘it’s me or the cats.’”Cat-lovers have responded with indignation and condemnation, sparking a wave of headlines and warnings that “kitty karma” could deny Buckley, 36, her first Academy award.She attempted to repair the damage on Jimmy Fallon’s chatshow on Thursday, saying it was a “misconception” that she loathed cats

The Guide #233: From Wonder Man to Girl Taken, here’s one thing to watch on every streamer

Streaming services: there’s a lot of them (with yet another, HBO Max, on the way later this month) and everyone seems to be signed up to different ones, making recommendations a challenge. Step forward the Guide’s fourth edition of A Show for Every Streamer (previous versions can be seen here, here and here), which does exactly as it describes. As is tradition, we’ve tried to avoid series that everyone has been nattering about (unlucky, Heated Rivalry), and instead spotlight less heralded, more surprising picks, starting with …Apple TV | Drops of God … a Japanese-American-French drama about warring wine experts, of course. A curious one, though it does fit in with Apple’s penchant for high-end subject matter. After a first series that saw the daughter of a deceased French wine expert face off against his Japanese mentee for ownership of his multimillion-dollar wine collection, season two – which arrived in January – sees the two team up to investigate the mysterious origins of a bottle of red from dad’s collection

Keir Starmer accused of ‘mimicking Trump’ with Middle East crisis TikTok post

Proportional representation is true rule by the people | Letters

Senior Labour figures warn government amid fears of ‘political earthquake’ in London

Crypto billionaire Christopher Harborne no longer interested in Reform-Tory pact

Nigel Farage to discuss Chagos Islands deal at Mar-a-Lago dinner with Donald Trump tonight – as it happened

Starmer is facing a cocktail of dissent that is growing ever more potent

Defence secretary accuses Tory and Reform MPs of ‘unpatriotic’ behaviour

Kemi is wrong about everything. Which is almost an achievement in itself | John Crace

Best way forward for Iran would be negotiated settlement, says Starmer

Starmer says UK sending more fighter jets to Middle East and first repatriation flight has left Oman – as it happened

Transparency fears over plan to redact 2,000 staff names on Commons register

Crypto investor based in Thailand donates further £3m to Reform

Rachel Roddy’s recipe for apple, honey and poppy seed cake | A kitchen in Rome

Honey is, among other things, a successful embalming agent. It is also a humectant, which isn’t an eager cyborg, but one of many short-chained organic compounds that are hygroscopic, meaning they attract and hold water, which in turn prevents hardening and encourages softness. Other hardworking humectants are glycerine, which is what keeps face creams creamy and hydrating, and sorbitol, which ensures toothpaste can be squeezed and smeared all over the sink and on the mirror. Honey, though, is the humectant that’s most suitable for this week’s recipe: a one-bowl, everyday cake inspired by my neighbour’s Polish honey cake, miodownik, combined with the tortino di mele e papavero (apple and poppy seed cake) enjoyed at a station bar in Bolzano.Not only does honey keep the cake moist, its sweetness comes largely from fructose, which is naturally sweeter than refined sugar, so the perception of sweetness is much greater even when less is added

My whey: dairy milk back on menu as protein boom cuts demand for plant-based alternatives

Gabriel Morrison hadn’t touched dairy milk for a decade until he read the ingredients label on his cheap carton of oat milk.“It’s [so much] canola oil and you imagine that in your glass, and imagine discovering that much olive oil, you’re like, that’s actually really gross,” he says.“I was just like, ‘ooft, I should stop this’.”The 28-year-old cinematographer had exclusively drunk soy, then almond, then oat milks since 2015 but had started worrying about processed foods – despite expert reassurance.In early 2025, with his housemate already buying cheaper dairy, he gave the old classic another look

It’s crunch time! Gala apples and nashi pears among Australia’s best-value fruit and veg for March

It’s a core month for pome fruit, with apples, pears and quince all heralding the start of autumn. “The first cab off the rank is the gala – a big sweet and juicy apple,” says Graham Gee, senior buyer at the Happy Apple in Melbourne.Granny smith, jazz and kanzi apples will come in during March too, and “Australia’s most popular variety, the pink lady, generally starts in April,” he says.Royal gala apples are between $5 and $8 per kilo at supermarkets. They’re $7 to $9 per kilo at Sydney’s Galluzzo Fruiterers, and Gee is selling them for about $3 to $5 per kilo; Spudshed in Perth is selling bags of prepacked new season apples for $3

How to turn limp rhubarb into tasty jam – recipe

Rachel de Thample is one of my food heroines. She’s the author of six books, and has also been course director of the College of Naturopathic Medicine’s natural chef diploma, head of food for Abel & Cole and commissioning editor of Waitrose Food Illustrated, among so much else. She trained with the likes of Marco Pierre White, Heston Blumenthal and Peter Gordon, and now teaches fermentation and gut health at River Cottage HQ, where I cut my own teeth in teaching eco-gastronomy more than 20 years ago. While researching honey fermenting recently, I came across her recipe in River Cottage’s Bees & Honey Handbook, which I’ve adapted here so you can make as much as you like using a variety of aromatics.The Guardian’s journalism is independent

£25 for a cookie? What the baffling luxury bakery boom tells us about Britain

Amid a cost of living crisis, pricey patisserie is all the rage – and not just in London. Our reporter goes on a crawl to find out if a tart can really be worth £45There was a time when you could get a stuffed vanilla cream slice or a neon-pink Tottenham cake for about £1 on the leafy, residential corner of Hackney, east London, where I stand today. But the branch of Percy Ingle bakery that was here for nearly 50 years is gone. In its place sits Fika, a cafe where a cinnamon bun costs £4.20 and a pistachio croissant will set you back nearly £5

Stuffed peppers and aubergine dip: Sami Tamimi’s recipes for savoury Palestinian snacks

I still remember, when I was a kid, the end of spring and early summer when markets in Jerusalem and across Palestine overflowed with freshly harvested freekeh. As you approached, the air carried a smoky, earthy aroma. Freekeh is an ancient grain, a staple across the Middle East and Turkey, made from green wheat roasted over open fires to burn off the husks, which gives it the characteristic nutty flavour. The name comes from the Arabic freek, meaning “to rub”, which describes how the grains are cleaned, dried, cracked and stored for the year.Throughout the Middle East and Palestine, mahashi (stuffing vegetables) is a true labour of love, creating dishes that are designed to be shared

Australian supermarket muesli bars taste test: the worst is ‘both dry and moist’

During a blind taste test of 19 muesli bars, for the first time in his life Nicholas Jordan asks: ‘Is this too much cinnamon?’Get our weekend culture and lifestyle emailIf you value our independent journalism, we hope you’ll consider supporting us todayI have a long history with muesli. Muesli bars were a recess staple during my school years. As a uni student, I made muesli in 20kg batches and sold it from my sharehouse back yard like a drug dealer. In lockdown, I started an Instagram account where I would review and rate a different muesli every three or four days (I am the only contributor to the hashtag #mueslireviewsli). Even before this taste test, I would guess that I’ve tried more than 80% of all the muesli and muesli bar brands available in my area

Why do my potatoes go black after cooking? | Kitchen aide

Why do some potatoes turn black on cooking, and how do I stop this happening? I usually leave them to cool in the cooking water, but should I plunge them in cold water instead?”Jean, Hampshire“We’ve all been there,” sympathises spud queen Poppy O’Toole. “It’s a harmless chemical reaction,” the author of The Potato Book continues, “but it looks rank and only gets worse with the slow cooling process that Jean’s using.” But let’s wind things back for a moment. According to the food science guru Harold McGee, in his bible On Food & Cooking, the darkening of cooked potatoes “is caused by the combination of iron ions, a phenolic substance [chlorogenic acid] and oxygen, which react to form a pigmented complex”. So what’s the solution? Make the pH of the water “distinctly acidic”, which McGee does by adding cream of tartar or lemon juice “after the potatoes are half-cooked”

‘Where the magic really happens’: the influencers out to celebrate – and save – Britain’s ‘proper boozers’

The Calthorpe Arms on Gray’s Inn Road is a fairly atypical central London pub. With patterned red carpets, brass fittings, leather bar stools, a pool table and Christmas tinsel still hanging in early February, it feels very much a “local”, although on a Thursday evening it’s busy with the post-work crowd.It’s the fifth time Niall Walsh, who works nearby and runs the Proper Boozers Instagram account, has visited in recent months. “It’s just off the beaten track, but easy to get to,” Walsh says over a pint of Harvey’s. “You can get a real, authentic pub experience

Stuffed battered chillies and chilli cheese toasties: Maunika Gowardhan’s favourite Holi snacks – recipes

Celebrate Holi, the festival of colours and the arrival of spring, with sumptuous, delicious and addictive snacks. The bharwa mirchi pakode ki chaat is full of flavour and topped with tamarind, green chutney and chaat masala. Alongside it, a street-food favourite from my home town of Mumbai: the classic chilli cheese toastie stuffed with potato, peppers and green chutney. Both are the sort of dishes you can eat at any time of day, and the unifying ingredient is the humble potato, which I feel is the backbone of Indian cooking, be it in curries, stir-fries, flatbreads, snacks and even raitas.I’d happily eat this delicious street-food classic on any day of the week

Rukmini Iyer’s quick and easy recipe for chard borani soup with yoghurt, crispy garlic and beans | Quick and easy

I am emphatically not a dip person (see also: salad), but the first time I tried chard borani, a Persian dip made with chard and yoghurt, I became so obsessed that we’ve been having it on repeat at home ever since. Today, I’m sharing my soup version, thickened with beans and topped with crisp garlic and brown butter. It’s perfect served with flatbreads, and takes just minutes to put together: a homage to the excellent original.If you’re making this in advance, reheat it very gently so as not to split the yoghurt.Prep 15 min Cook 30 minServes 3-42 tbsp olive oil 1 large onion, peeled and roughly sliced2 garlic cloves, peeled and finely grated400g rainbow or Swiss chard, stems roughly chopped, leaves roughly sliced2 tsp sea salt flakes 1 400g tin haricot beans, drained and rinsed (260g drained weight)Juice of ½ lemon150g natural or greek yoghurt, at room temperature , plus extra to serve For the crisp garlic butter 40g salted butter2 garlic cloves, peeled and finely sliced2 tsp aleppo pepper (optional)Heat the oil in a large, wide-based pan, add the onion and stir-fry on a medium to high heat for five minutes

How to make the perfect bara brith – recipe | Felicity Cloake's How to make the perfect …

Bara brith, the traditional Welsh fruit loaf whose name means speckled bread, is, as Ben Mervis notes, not dissimilar to Yorkshire brack, Irish barmbrack and Scottish “kerrie loaf” – the last is a new one on me, though, of course, I’m more than familiar with how well they all pair with strong tea and cold salty butter. According to food writers Laura Mason and Catherine Brown, they were originally known as teisen dorth in south Wales, and they date the recipe to no earlier than the beginning of the 20th century. However, the digitising of records since their book Food of Britain was published in 1999 allowed me to find a reference to it being eaten before school examinations in Bala, Gwynedd, in Seren Cymru from 1857. (Pen Vogler notes that “anything made with flour, however, is likely to be relatively modern, as wheat was too unreliable to be a staple in wet, upland Wales.”) There’s no reason to doubt the pair’s claim that bara brith was originally made from excess bread dough, but I think it’s good enough to need no such excuse

Stephen Colbert on Kristi Noem: ‘A domestic terrorist who deserves to go to Gitmo’

Stephen Colbert on Republican double-speak for war in Iran: ‘A war that got a thesaurus for Christmas’

Nothing beats the smell of oil and steam | Brief letters

Seth Meyers on Trump spilling military secrets: ‘He’s so excited to bomb people, he can’t help himself’

Actor reaches settlement with Old Vic theatre over Kevin Spacey assault claims

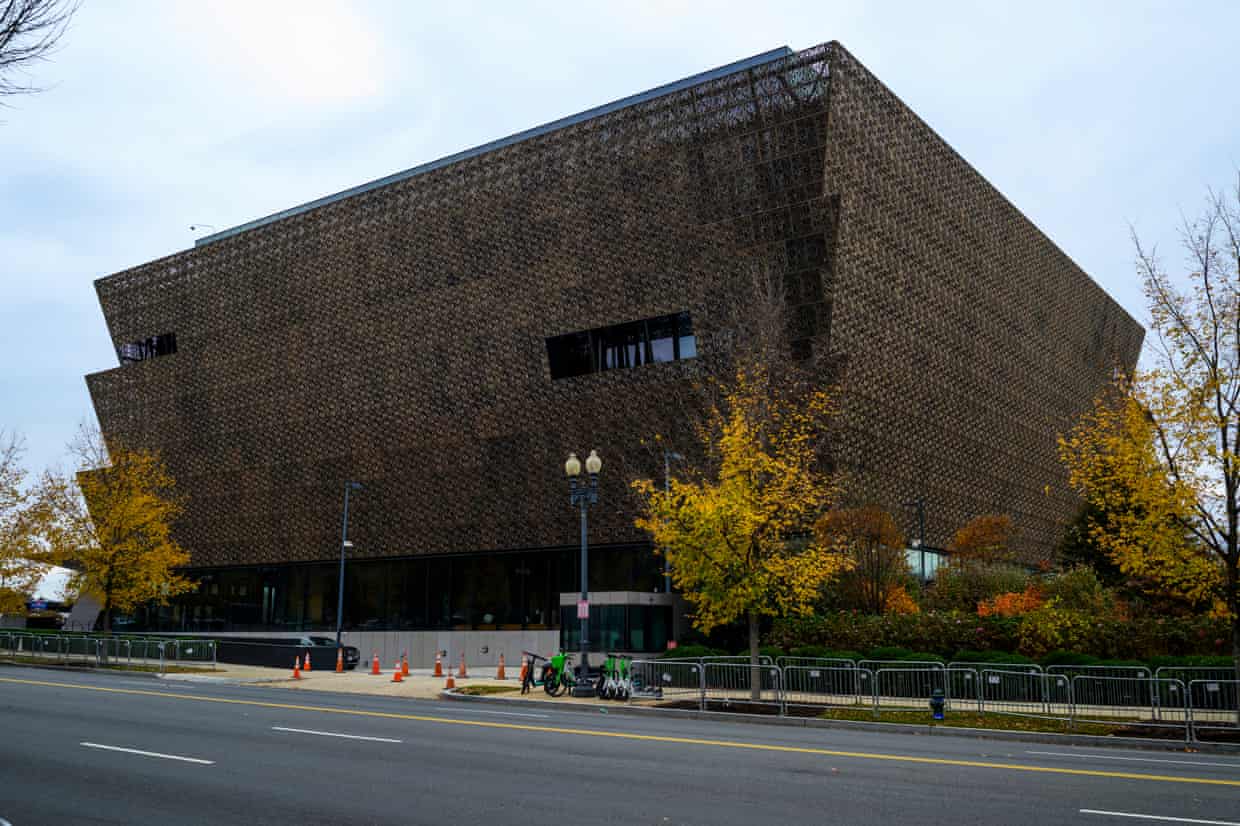

‘Excellence’: Smithsonian exhibit celebrates HBCUs amid attacks on Black history

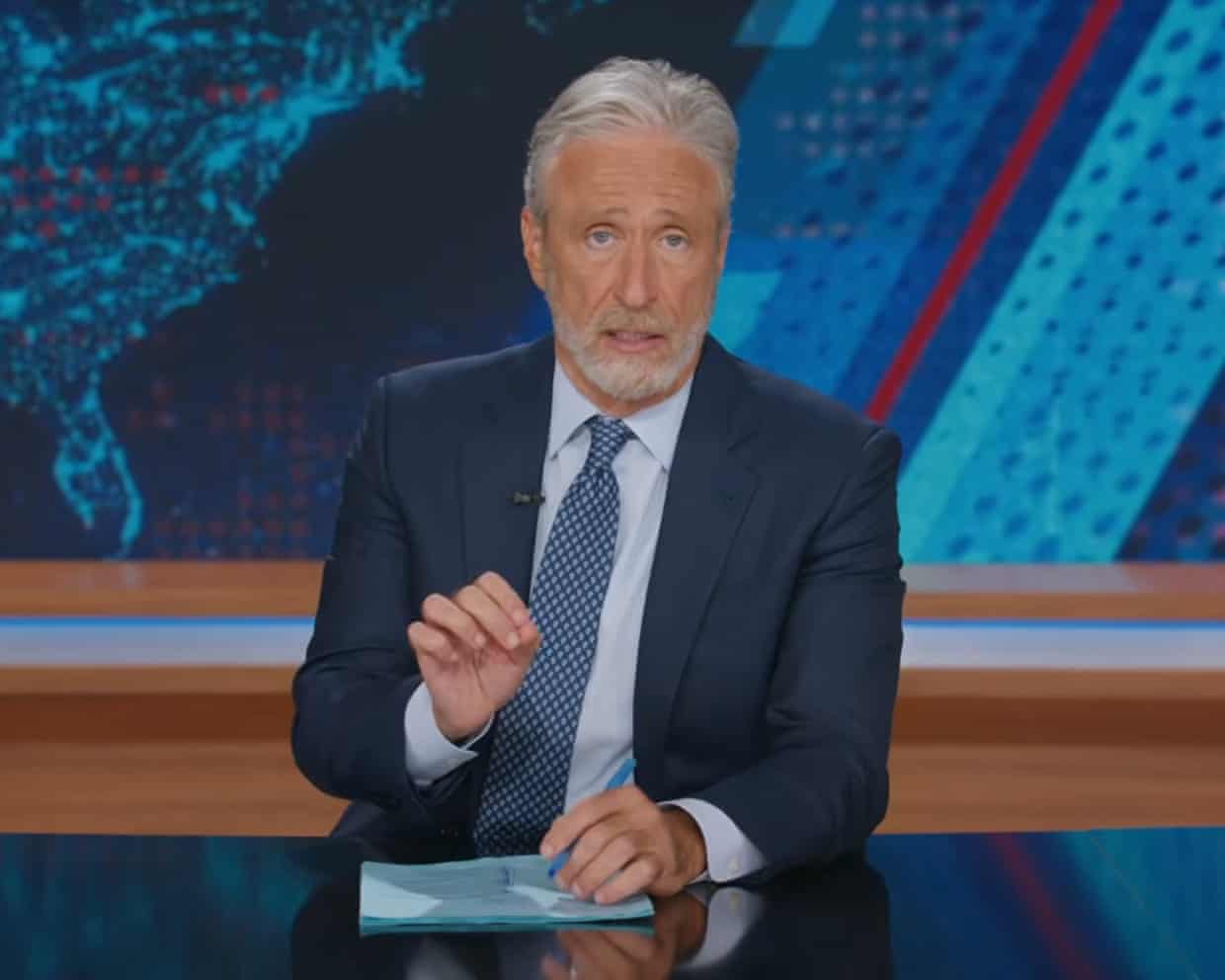

Jon Stewart on US attacks in Iran: ‘A war with no clear purpose, no end in sight’

‘My guitar was mangled – like my life!’ Goo Goo Dolls on how they made epic ballad Iris

My cultural awakening: Leonardo da Vinci made me rethink surgery – I’ve since mended more than 3,000 hearts

The Guide #232: From documentary shock to Bafta acclaim – how the screen shaped our understanding of Tourette’s

Pulp have the last word in Adelaide festival saga with triumphant opening gig

Seth Meyers on Team Trump’s Iran threats: ‘These guys speak like they’ve been hit on the head’