We may not be running out of gas but we still need a serious strategic gas reserve | Nils Pratley

Alarmed that Great Britain has only enough gas in storage to cover two days of consumption? Actually, Michael Shanks, the energy minister, is right that the bald statistic is not a reason to run for the hills. But he would help his case if he admitted that the long era of running a “just-in-time” approach to gas supplies looks increasingly unworkable.Shanks is obviously correct that Great Britain does not source its supplies from storage. About 75% of our gas comes from the North Sea – from domestic fields and via the 725-mile underwater Langeled pipeline from Norway – and neither source is affected by the war in Iran.As for imported liquefied natural gas (LNG), typically about 18% of supplies today, the market is disrupted now that Qatar, about a fifth of the global market, is not producing

Golf club firm owned by Trump’s sons merges with drone manufacturer

A golf club company backed by the sons of Donald Trump is merging with drone manufacturer Powerus in a deal designed to take the drone technology company public.The merger with Aureus Greenway Holdings is the latest in Eric and Donald Trump Jr’s growing investments in the drone sector, following last month’s $1.5bn tie-up between Israeli drone maker XTEND and Florida-based JFB Construction Holdings. Drones have become a major procurement priority for the Pentagon and are widely used in Ukraine, where dense air defense systems near the front lines limit the deployment of conventional aircraft.This growing reliance has also drawn significant Silicon Valley funding into drone and military artificial intelligence startups, boosting valuations of US companies such as Anduril Industries and Shield AI

X suspends 800m accounts in one year amid ‘massive’ scale of manipulation attempts

Elon Musk’s X said it had suspended 800m accounts over a 12-month period as it fights the “massive” scale of attempts to manipulate the platform.The social media company told MPs it was continually fighting state-backed attempts to hijack the agenda on its network, with Russia the most prolific state actor, followed by Iran and China.As part of the battle against such content, X suspended 800m accounts in 2024 for breaching its rules on platform manipulation and spam, although it did not reveal which of those suspensions related to foreign interference. X has approximately 300 million monthly users worldwide.Wifredo Fernández, a government affairs executive at the platform’s parent company, X Corp, said: “There are efforts every single day to create inauthentic networks of accounts

AI firm Anthropic sues US defense department over blacklisting

Anthropic filed two lawsuits against the Department of Defense on Monday, alleging that the government’s decision to label the artificial intelligence firm a “supply chain risk” was unlawful and violated its first amendment rights. The two sides have been locked in a monthslong heated feud over the company’s attempt to implement safeguards against the military’s potential use of its AI models for mass domestic surveillance or fully autonomous lethal weapons.The lawsuits, which Anthropic filed in the northern district court of California and the US court of appeals for the Washington DC Circuit, come after the Pentagon formally issued the supply chain risk designation last Thursday, the first time the blacklisting tool has been used against a US company. The AI firm previously vowed to challenge the designation and its demand that any company that does business with the government cut all ties with Anthropic, a serious threat to its business model.Anthropic’s lawsuit contends that the Trump administration is punishing the company for its refusal to comply with the ideological demands of the government, in a violation of its protected speech and an attempt to punish the company for not complying

‘We all believe in the plan,’ says England’s Ben Spencer

England have vowed to double down on their kick-heavy gameplan against France on Saturday despite their drastic decline in recent weeks. It is a move that risks further provoking the anger of their supporters.Steve Borthwick and his side have come under intense scrutiny after last week’s first defeat by Italy and the manner in which they stuck rigidly to their kicking strategy left fans irate. England have kicked the most times and for the most metres of all the Six Nations teams and while it was a tactic that paid dividends last autumn when they were on a 12-match winning run, it is no longer having the desired effect.The 2003 World Cup winner Matt Dawson has warned that relying too heavily on their kicking game in Paris would be a “red flag against England’s coaching ticket”

Dolphins take $99m hit on Tagovailoa and sign Willis; Tampa’s star WR Evans heads to 49ers

The Miami Dolphins are moving on from Tua Tagovailoa, the quarterback they drafted with the fifth overall pick in 2020 in hopes of turning the franchise’s fortunes around.“As we move forward, we will be focused on infusing competition across the roster and establishing a strong foundation for this team as we work towards building a sustained winner,” Dolphins general manager Jon-Eric Sullivan said in a statement on Monday.The move will cost the Dolphins an NFL record $99m in dead money against the salary cap. ESPN reported that the move will be designated after 1 June, meaning the Dolphins will spread the hit to their salary cap across two years ($67.4m in 2026, $31

How high could oil prices go – and what might the global economic fallout be?

Rachel Reeves warns fuel retailers not to make ‘excess profits’ from oil crisis; G7 ‘stands ready’ to release crude reserves – as it happens

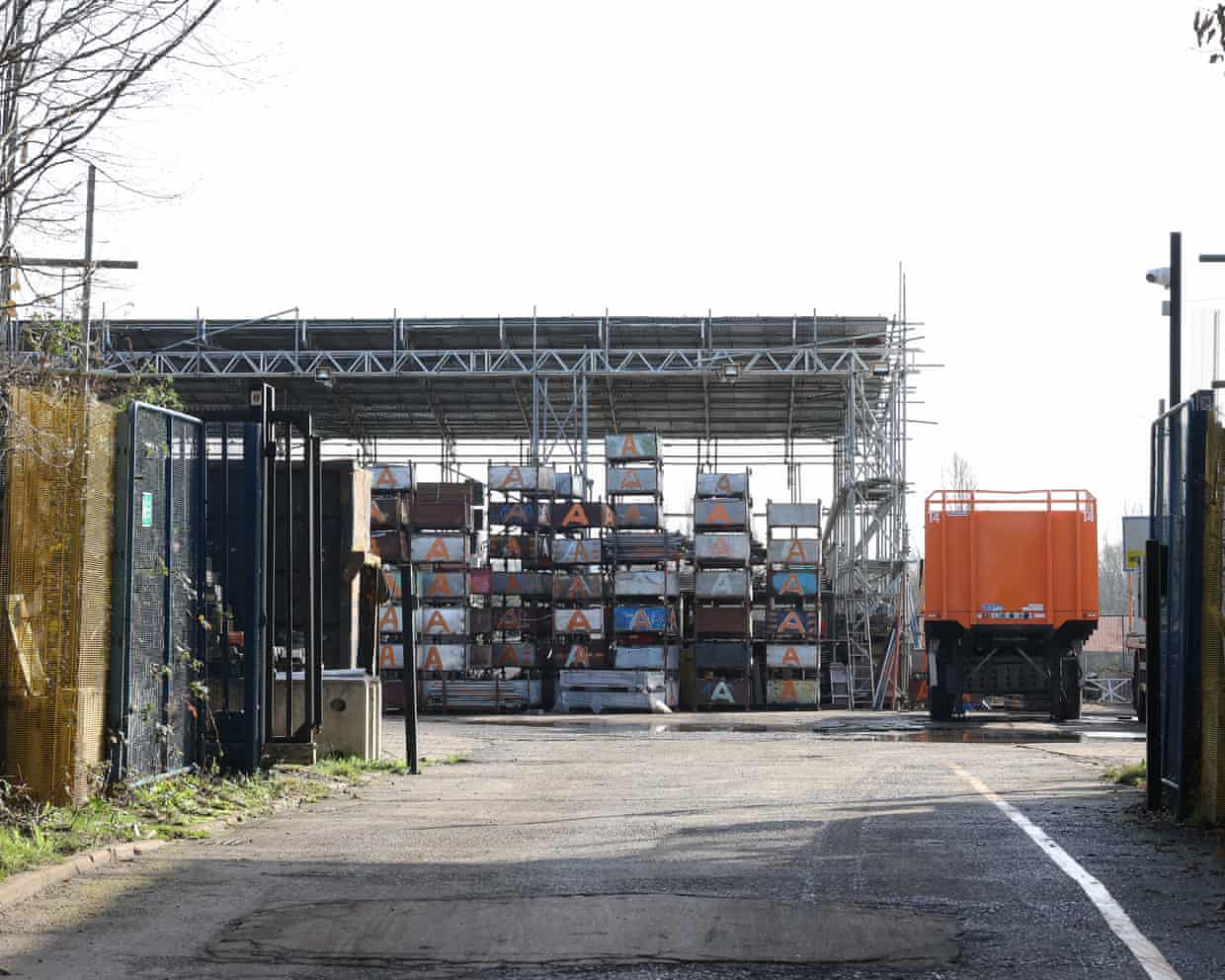

From press release … to scrap metal site: the Essex ‘supercomputer’ that’s still a scaffolding yard

Revealed: UK’s multibillion AI drive is built on ‘phantom investments’

‘Revolutionary’: Ukrainian para-biathlete wins silver using ChatGPT as his coach

Cheltenham festival day one: The New Lion can roar in Champion Hurdle