NEWS NOT FOUND

Gerry Adams ‘as culpable as those who planted IRA bombs’, high court hears

Gerry Adams is as culpable for IRA bombings on the UK mainland as the individuals who planted and detonated the devices, the high court has heard at the beginning of a civil trial.The former Sinn Féin leader is being sued for symbolic “vindicatory” damages of £1 each by John Clark, Jonathan Ganesh and Barry Laycock, who were injured respectively in the 1973 Old Bailey bombing, and the London Docklands and Manchester bombings in 1996.They allege that Adams, who is credited with helping to bring about the Northern Ireland peace process, “was an instrumental force in the organisation of the PIRA [provisional IRA] and building of the two-strand attack – ArmaLite and the ballot box. A foot in each camp.”Opening the claimants’ case in London on Monday, Anne Studd KC, said in written submissions: “Their focus is to shine a light upon the involvement of the defendant in the PIRA in the course of that conflict and to prove on balance of probabilities that he [Adams] was so intrinsically involved in the PIRA organisation that he is as culpable for the assaults giving rise to these claims as the individuals who planted and detonated the bombs

Missing money, shipped chips and a 350,000% profit: key takeaways on AI ‘phantom investments’

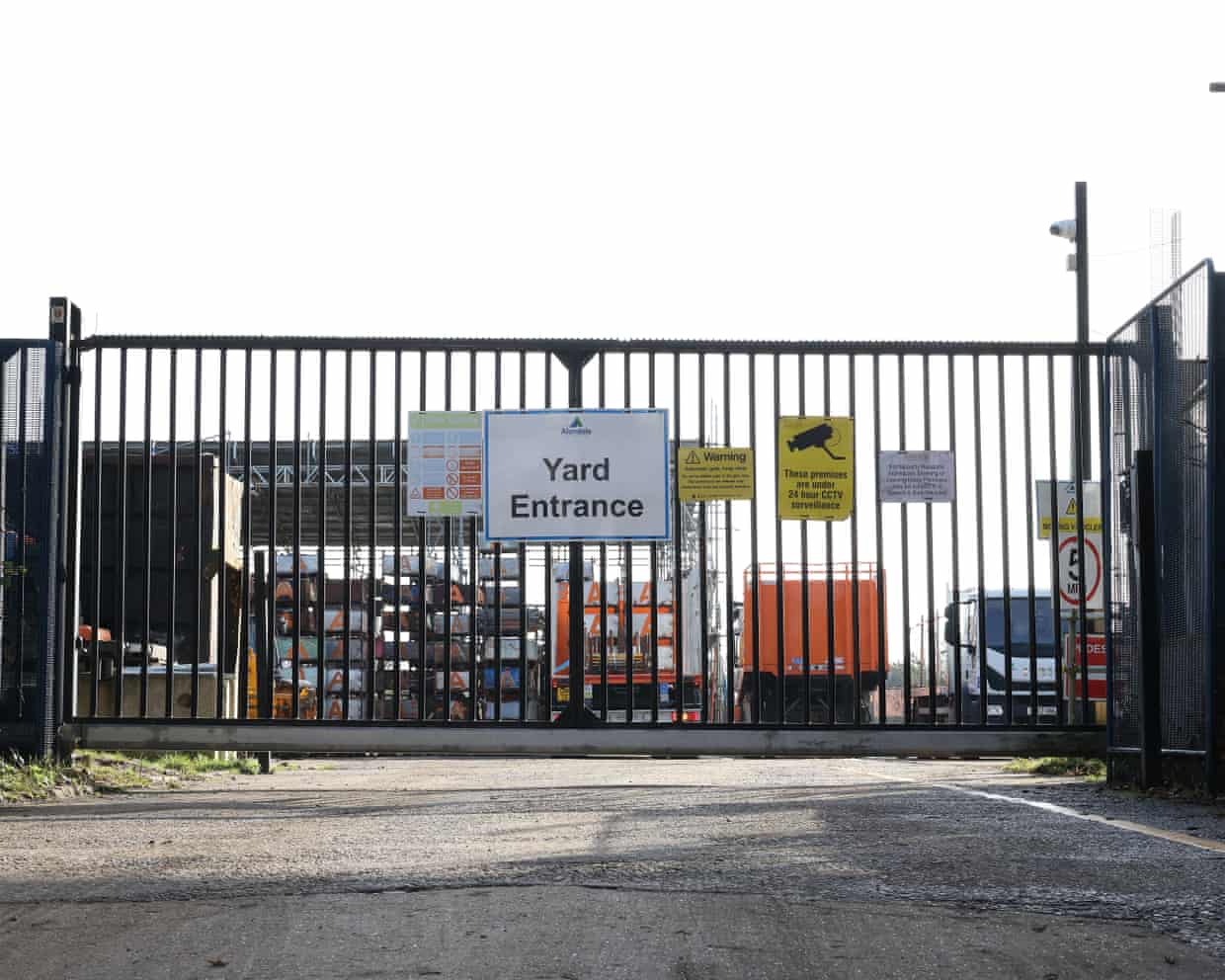

A Guardian investigation has examined a series of massive AI investments announced by the government over the past two years, comparing what was promised with what has so far been delivered.The investigation centres on two companies backed by the chipmaker Nvidia and central to the UK’s AI plans, Nscale and CoreWeave.It has found that large, promised sums do not represent real investments into the UK’s economy, that new datacentres are not in fact new, and that a giant supercomputer set to be online later this year is still being used by a construction company in Essex.Here are some of the key details at a glance.The Guardian visited a site in Essex that is supposed to host “one of the most powerful AI computing centres ever built”, built by Nscale

Starmer warns of bigger impact on economy the longer Iran war continues - as it happened

Addressing the war in Iran, Keir Starmer acknowledged that the longer the conflict went on the greater the likely impact on the UK’s economy. The prime minister said:double quotation markThe job of government is obviously to get ahead, to look around the corner, to work with others, and the chancellor speaks to the governor of the Bank of England on a daily basis, with looking cross-departmental within government, assessing the risks, monitoring and talking to our international partners as well about what more we can do together to reduce the likely impact on people here and businesses here, of course.But it is important to acknowledge that that work is needed, because people will sense, you will sense I think, that the longer this goes on, the more likely the potential for an impact on our economy, impact into the lives and households of everybody and every business.And our job is to get ahead of that, to look around the corner, assess the risk, monitor the risks, and work with others in relation to that.The longer the US-Israel war with Iran continues, the more likely it is there will be economic damage in the UK, Keir Starmer warned as governments around the world braced for major disruption to energy supplies as a result of the escalating US-Israeli war with Iran

Lengthy US-Iran war would affect ‘lives and households of everybody’, says Starmer

Keir Starmer has said that a long-term US-Iran war would affect the “lives and households of everybody”, as the head of the AA advised motorists against making “non-essential” journeys.On Monday, oil prices surged past $100 (£75) a barrel for the first time since 2022, which will feed through to higher costs at petrol stations, and consumers will also be hit if energy costs push up inflation.Ministers are understood to be looking at ways to potentially mitigate the rising costs on energy bills – and are likely to come under pressure to cancel a planned 5p rise in fuel duty this autumn.Speaking as he launched the government’s community cohesion plan, Starmer said: “The job of government is obviously to get ahead, to look around the corner, to work with others, and the chancellor speaks to the governor of the Bank of England on a daily basis … assessing the risks, monitoring and talking to our international partners as well about what more we can do together to reduce the likely impact on people here and businesses here, of course.“But it is important to acknowledge that work is needed, because people will sense … that the longer this goes on, the more likely the potential for an impact on our economy, impact into the lives and households of everybody and every business

Nigel Farage invests £215,000 in Kwasi Kwarteng’s bitcoin firm

Nigel Farage has invested in Kwasi Kwarteng’s bitcoin reserves company, as the leader of Reform UK aligns himself closer with the cryptocurrency industry.The MP has invested £215,000 in Stack BTC, the crypto business that is chaired by the former Conservative chancellor.Farage, who has long courted the UK’s crypto sector, said he was delighted to have “become an investor in Stack” and “lend my support to the team”.“I have long been one of the UK’s few political advocates for bitcoin, recognising the role digital currencies will play in the future of business and finance,” he said in a statement. “I believe that we can and should be a major global hub for the crypto industry

Labour in ‘deep trouble’ with Black voters, Operation Black Vote chair warns

Labour is in “deep trouble” with Black voters, a former government adviser has warned, saying the party is at risk of being seen as “accepting the normalisation of racism”.David Weaver, who is the chair of Operation Black Vote (OBV), said the government’s plans to restrict juries would “heighten, normalise and embed” racial disproportionality in the justice system and that Black voters were saying: “We don’t know what Labour stands for any more.”In November, Keir Starmer vowed to “stand up to racism”. But the “moral panic” over migration and slow progress on tackling racial pay gaps and the Windrush scandal meant sentiment was low, Weaver said.“We’re not happy,” he added

Gambling crackdown in Romania as councils can ban ‘toxic’ betting shops

Cancer death rate in Britain down by almost a third since 1980s

NHS England pauses new referrals for masculinising or feminising hormone treatment in under-18s

Labour to set up new extremism whistleblowing service for university staff

Recreational drugs can more than double risk of stroke, study suggests

Martha’s rule may have saved 400 lives so far in England, figures show