NEWS NOT FOUND

Trillium, Birmingham B4: ‘There’s a general feeling of people – gasp! – actually enjoying life’ – restaurant review | Grace Dent on restaurants

Trillium, the latest Birmingham restaurant by Glyn Purnell, is absolutely not one of those po-faced, sedate, mumbly kind of places where some Ludovico Einaudi is piped plinky-plonkily throughout the dining room while guests stiffly eat six teensy courses. In fact, it’s quite the opposite, even if Purnell, via the likes of Purnell’s and Plates, is pretty much synonymous throughout the Midlands with fancy, special-occasion, Michelin star-winning refinement. Yet on a recent Saturday night, in this brand new, glass-fronted, multicoloured mock birdcage, the talk is loud, the music is roaring and the plates of battered potato scallop with soured cream are appearing thick and fast.Trillium is a genuine attempt by a Michelin-starred restaurateur to translate some of their best bits into a semi-rowdier yet still upmarket stage. It’s been attempted many times by other chefs (see Corenucopia and Bar Valette for details), but, miraculously, Purnell seems to have pulled it off

Has dinner been served with a side of romance? | Brief letters

I can’t be the only person wondering if Dining across the divide (1 March) is possibly resulting in more romantic liaisons than Blind date? Some of them are heartwarming.Ed ClarkeManchester Why all the excitement about a cricket ground within the boundaries of a World Heritage Site (Letters, 27 February)? Derwent Valley Mills has five (viz Cromford Meadows, Ambergate, Belper Meadows, Duffield Meadows and Darley Abbey).Paul EnglishBelper, Derbyshire My anorak has a “funnel” neck (Hiding in plain sight: everyone from Meghan to the Beckhams wants a funnel neck, 27 February). Fortunately, it doesn’t allow rain to cascade through it.Theresa GrahamClevedon, Somerset I was surprised and pleased to see Felicity Cloake’s reference to Farmhouse Fare (How to make the perfect bara brith – recipe, 1 March)

Helen Goh’s recipe for lemon curd layer cake | The sweet spot

This is both simple and celebratory, which in my book makes it just right for Mother’s Day next weekend. It has a fine, tender crumb, which pairs beautifully with the soft, creamy tang of lemon mascarpone, and I use lemon curd in the batter (shop-bought for ease) to bring a particular smoothness and depth of lemon flavour. Finished with a little extra curd and a scattering of edible flowers, it is pretty and unfussy and will hopefully make your own mother’s day.Prep 5 min Cook 1 hr Serves 8-10330g plain flour 2½ tsp baking powder ½ tsp fine sea salt 225g room-temperature unsalted butter225g caster sugar Finely grated zest of 2 lemons 3 large eggs, at room temperature160g lemon curd 250ml whole milk Small edible flowers, to decorateFor the lemon mascarpone 250g lemon curd, plus extra to decorate250g mascarponeHeat the oven to 180C (160C fan)/350F/gas 4 and line the base and sides of two 20cm round cake tins with baking paper.Sift the flour, baking powder and salt into a medium bowl

Women built, and still shape, our culinary culture every day

On 8 March each year, the calendar lights up: dinners celebrating women, panel talks, articles and online events amplifying female voices. The mood on International Women’s Day is joyful, the conversations energised and it feels as if the world is finally paying attention. But then 9 March arrives. Do the celebrations stop? Do we tuck away the banners with the last of the desserts? When the events conclude, are women no longer worth celebrating? The sad truth is that many International Women’s Day events can feel like lip service.Less so in the food world – or at least in our corner of it

The future is rosy for English red wines

When did you last buy a bottle of English red wine? Chances are, you never have. Though increasingly available on the high street – Ocado and Waitrose Cellar both stock a couple – reds grown in Blighty have struggled to shift a reputation for being overpriced: the vast majority still cost £15-25 a bottle, which is well outside what most people might consider “everyday drinking”.The Guardian’s journalism is independent. We will earn a commission if you buy something through an affiliate link. Learn more

Rachel Roddy’s recipe for apple, honey and poppy seed cake | A kitchen in Rome

Honey is, among other things, a successful embalming agent. It is also a humectant, which isn’t an eager cyborg, but one of many short-chained organic compounds that are hygroscopic, meaning they attract and hold water, which in turn prevents hardening and encourages softness. Other hardworking humectants are glycerine, which is what keeps face creams creamy and hydrating, and sorbitol, which ensures toothpaste can be squeezed and smeared all over the sink and on the mirror. Honey, though, is the humectant that’s most suitable for this week’s recipe: a one-bowl, everyday cake inspired by my neighbour’s Polish honey cake, miodownik, combined with the tortino di mele e papavero (apple and poppy seed cake) enjoyed at a station bar in Bolzano.Not only does honey keep the cake moist, its sweetness comes largely from fructose, which is naturally sweeter than refined sugar, so the perception of sweetness is much greater even when less is added

How high could oil prices go – and what might the global economic fallout be?

Rachel Reeves warns fuel retailers not to make ‘excess profits’ from oil crisis; G7 ‘stands ready’ to release crude reserves – as it happens

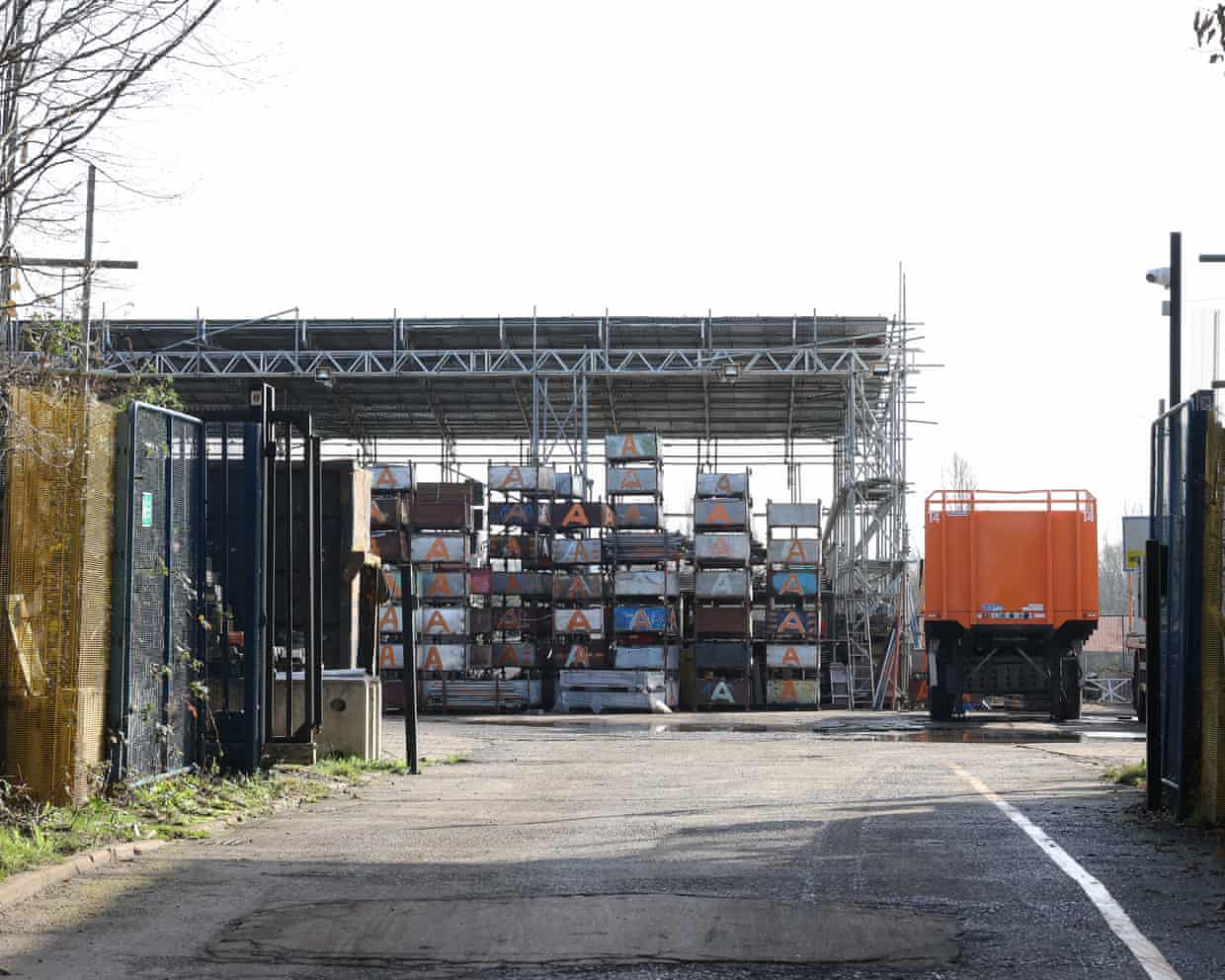

From press release … to scrap metal site: the Essex ‘supercomputer’ that’s still a scaffolding yard

Revealed: UK’s multibillion AI drive is built on ‘phantom investments’

‘Revolutionary’: Ukrainian para-biathlete wins silver using ChatGPT as his coach

Cheltenham festival day one: The New Lion can roar in Champion Hurdle