NEWS NOT FOUND

How high could oil prices go – and what might the global economic fallout be?

Fears over the global economy have been stoked by the oil price soaring past $100 a barrel as a result of the US-Israel war with Iran.Economists say the increasing likelihood of a prolonged conflict in the vital energy exporting region could have serious consequences for living standards around the world amid the threat of a renewed inflation shock.Against a highly uncertain backdrop, financial markets are under heavy selling pressure, consumers are facing rising prices, central banks could be forced to increase borrowing costs and governments will come under pressure to support households and businesses.Oil prices passed $119 a barrel on Monday, the highest level since Russia’s full-scale invasion of Ukraine in February 2022. Analysts say the continued closure of the strait of Hormuz could drive the price close to $150 a barrel, above the record high of $145

Rachel Reeves warns fuel retailers not to make ‘excess profits’ from oil crisis; G7 ‘stands ready’ to release crude reserves – as it happens

Time for a recap, after a dramatic day in the financial markets.UK chancellor Rachel Reeves has warned petrol, diesel and heating oil retailers not to take advantage of the surge in oil prices.Updating MPs about the situation, after an alarming surge in oil prices last night, Reeves said she would “continue to monitor prices” at the pumps as the situation develops.She told the House of Commons:double quotation markI have also asked the Competition and Markets Authority to be vigilant across prices, including essentials like road fuel and heating oil.Let me be absolutely clear

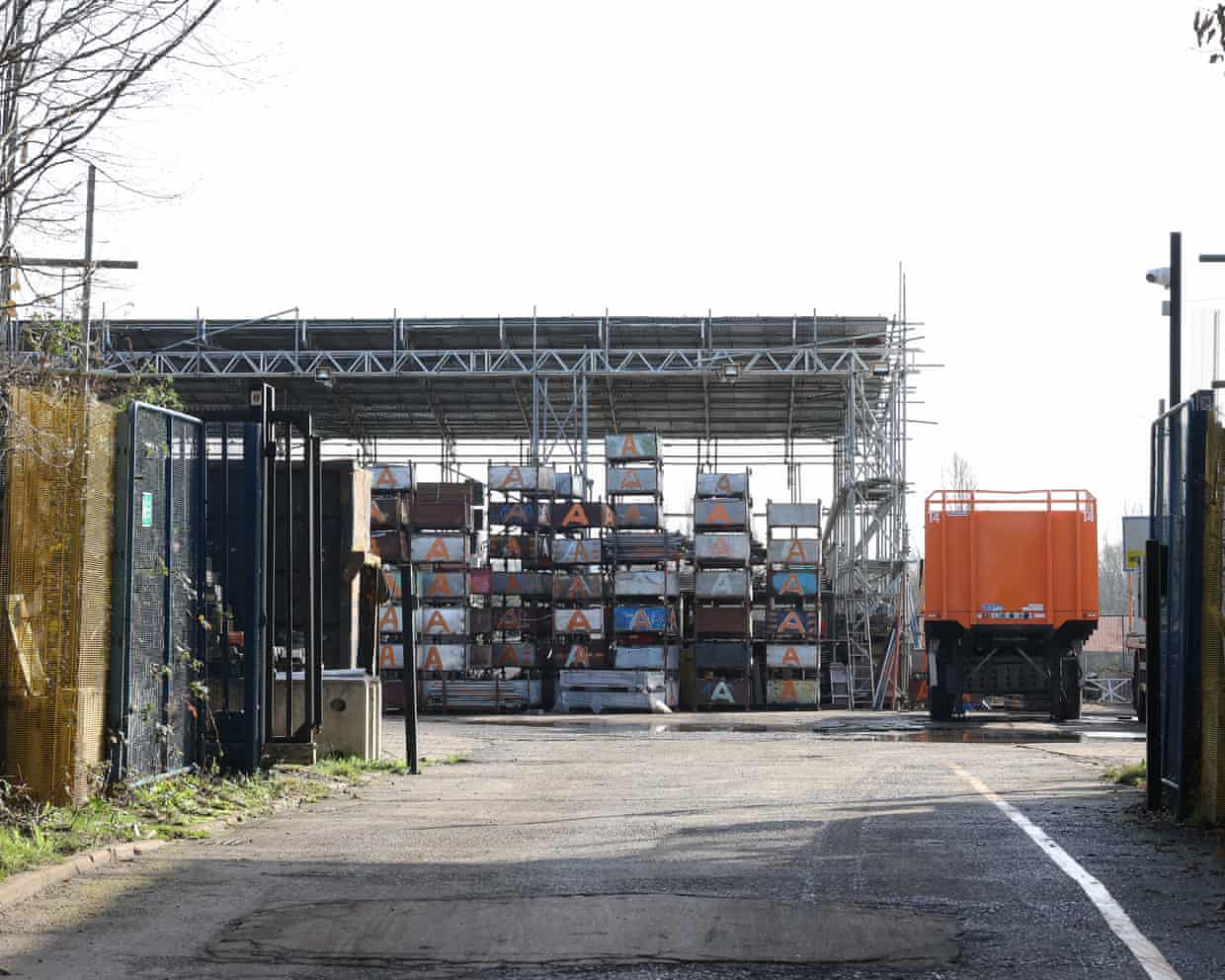

From press release … to scrap metal site: the Essex ‘supercomputer’ that’s still a scaffolding yard

The press releases announcing a gleaming supercomputer on the outskirts of north London depict a glass and concrete building, rising from a tree-lined street. Accompanied by images of glowing blue robot faces, it looks like the centre of a technological revolution.By the end of this year, that artist’s impression is supposed to be a reality.But when the Guardian visited last month, there was no sign of it. Instead, the four-acre plot in Loughton was a depot stacked with pylons and scrap metal under a corrugated roof, while flatbed lorries drove in and out stacked with poles

Revealed: UK’s multibillion AI drive is built on ‘phantom investments’

Exclusive: Rented datacentres and ‘supercomputer’ site that’s still a scaffolding yard raise questions for Starmer’s push to ‘mainline AI into veins of economy’From press release … to scrap metal site: the Essex supercomputer that’s still a scaffolding yardA multibillion-pound drive to “mainline AI into the veins” of the British economy is riddled with “phantom investments” and shaky accounting, a Guardian investigation has found.Since 2024, successive Conservative and Labour governments have proclaimed massive deals to build new datacentres, create thousands of jobs and construct a supercomputer.The investments – led by two firms linked to AI giant Nvidia - have been touted as a cornerstone of the government’s promise to use tech to turbocharge the economy.On Monday, former UK deputy prime minister Sir Nick Clegg and former Meta chief operating officer Sheryl Sandberg were announced as new board members at one of the firms, NScale. Nscale also said it had raised a $2bn funding round, sending its valuation soaring to $14

‘Revolutionary’: Ukrainian para-biathlete wins silver using ChatGPT as his coach

Team Ukraine have hit the ground running at the Winter Paralympics, standing second in the medal table after three days of competition. Their resolve and determination has been inspirational to many, but one athlete has revealed a secret weapon in their search for a competitive edge: using ChatGPT as a coach.Maksym Murashkovskyi won silver in the men’s visually impaired biathlon on Sunday and he did not miss a shot. He has also been working with OpenAI’s large language model for six months, using artificial intelligence not just for coaching advice but psychological and health guidance too.“For the past six months, I have been training with ChatGPT,” Murashkovskyi said after his victory

Cheltenham festival day one: The New Lion can roar in Champion Hurdle

Lossiemouth’s presence means the selection is an attractive bet to follow up last year’s novice win at this meetingThe sporting decision to send Lossiemouth, the Mares’ Hurdle winner for the last two seasons, in against all-comers in Tuesday’s Champion Hurdle adds considerably to the depth of the competition, but it has also prompted a minor drift in the price of The New Lion and he is an attractive bet to follow up last year’s novice win at this meeting.Unlike the other three runners at single-figure odds for Tuesday’s feature event, The New Lion does not benefit from a 7lb mares’ allowance. While Brighterdaysahead, Golden Ace and Lossiemouth have 12, 12 and 17 runs behind them respectively, however, The New Lion has just half a dozen, with five wins and just one defeat when he made an uncharacteristic jumping error at Newcastle in December.The three mares also have some questions to answer. Lossiemouth was below her best behind Brighterdaysahead at Leopardstown last time and has first-time cheekpieces on Tuesday, while Brighterdaysahead ran no sort of race in last year’s Champion

My cultural awakening: a Rihanna song showed me how to live as a gay man in Iran

From The Bride! to Harry Styles: your complete entertainment guide to the week ahead

Stephen Colbert on Kristi Noem: ‘A domestic terrorist who deserves to go to Gitmo’

Stephen Colbert on Republican double-speak for war in Iran: ‘A war that got a thesaurus for Christmas’

Nothing beats the smell of oil and steam | Brief letters

Seth Meyers on Trump spilling military secrets: ‘He’s so excited to bomb people, he can’t help himself’