UK deal with EU will not return to ‘arguments of the past’, minister says

The UK’s new deal with the EU will be a break from “debates and arguments of the past”, the UK’s chief negotiator, Nick Thomas-Symonds, has said, pledging that growth will be the highest priority of the talks.Meanwhile, Keir Starmer held talks with the European Commission president, Ursula von der Leyen, in London, as momentum builds towards a crucial EU-UK summit in May.In the most positive language yet about the talks, No 10 said Starmer and von der Leyen had agreed to aim for “as ambitious a package as possible” at the first UK-EU summit next month.“The prime minister was clear that he will seize any opportunity to improve the lives of working people in the United Kingdom, drive growth and keep people safe – and he believes a strengthened partnership between the UK and the EU will achieve this,” No 10 said after the meeting.Amid pressure from MPs to agree a youth mobility deal despite a cabinet split on the proposal, the Cabinet Office minister Thomas-Symonds said in an article for the Guardian that the negotiations should move on from the turmoil of the Brexit years

Tory mayor joins calls for deal with Reform UK at next general election

Ben Houchen, a Conservative mayor, has joined calls for his party to make some kind of deal with Nigel Farage’s Reform UK before the next election.The Tees Valley mayor, who is the Tories’ most powerful elected politician, said he wanted to see a coming together of the two rightwing parties.He told Politico: “I don’t know whether it’s a merger … [or] a pact of trust and confidence or whatever … But if we want to make sure that there is a sensible centre-right party leading this country, then there is going to have to be a coming together of Reform and the Conservative party in some way. What that looks like is slightly above my pay grade at the moment.”His comments came after Robert Jenrick, the shadow justice secretary, was recorded saying he wanted to unite the coalition on the right of politics “one way or another”

Starmer and Reeves try to ride three horses with US, EU and China trade ties

Riding two horses is hard enough, but diplomats are joking in private that Keir Starmer and Rachel Reeves are trying to ride three.At the International Monetary Fund summit in Washington this week, Reeves sought to position the UK as a beacon of free trade that is open to business with the EU, US and China.Riding those three horses is central to the government’s strategy for boosting growth and navigating the international stage at a time when old alliances are being upended and the post-cold war order redrawn.What Reeves did not address is that the UK is being pulled in opposing directions that may soon force ministers to make choices between Brussels, Washington and Beijing.Before the chancellor’s trade talks with the US treasury secretary, Scott Bessent, on Friday, it emerged that the US was pushing the UK to relax its rules on agricultural imports – the rules that ban chlorine-dipped chicken and hormone-treated beef from being sold in British supermarkets

UK politics: Reform will axe councils’ special needs funding if they win in local elections, Lib Dems claim – as it happened

The National Autistic Society has described Nigel Farage’s comments about Send children (see 12.09pm) as “wildly inaccurate” and accused him of perpetuating “stigma” and making life harder for disabled people. Mel Merritt, head of policy and campaigns at the NAS, said:Nigel Farage’s comments are wildly inaccurate and show that he’s completely out of touch with what autistic children and adults have to go through to get a diagnosis or any support at all.For the record, absolutely no one has got an autism diagnosis through the GP – this is just incorrect, wrong, fake news.Children with Send and disabled adults, including autistic people, are not victims who are being ‘over diagnosed’

Charities attack Farage claims of ‘mental illness problems’ overdiagnosis

Nigel Farage says the UK is “massively overdiagnosing those with mental illness problems” and creating a “class of victims”.In comments, which have drawn criticism from campaigners and charities, the leader of Reform UK said it was too easy to get a mental health diagnosis from a GP.“It’s a massive problem. I have to say, for my own money, when you get to 18 and you put somebody on a disability register, unemployed, with a high level of benefits, you’re telling people aged 18 that they’re victims,” he told a local elections press conference in Dover.“And if you are told you’re a victim, and you think you’re a victim, you are likely to stay [a victim]

Lowering the voting age will benefit democracy | Letters

Simon Jenkins disagrees with the government’s proposal to reduce the voting age to 16 (Votes for 16-year-olds? Sorry, but I’m not convinced, theguardian.com, 17 April). But the voting age of 18 is an arbitrary threshold. Quite a recent one too – until 1969 the minimum voting age in Britain was 21. Other countries have minimum voting ages from 16 to 21

Jimmy Kimmel on Pete Hegseth: ‘Our secretary of defense is defenseless’

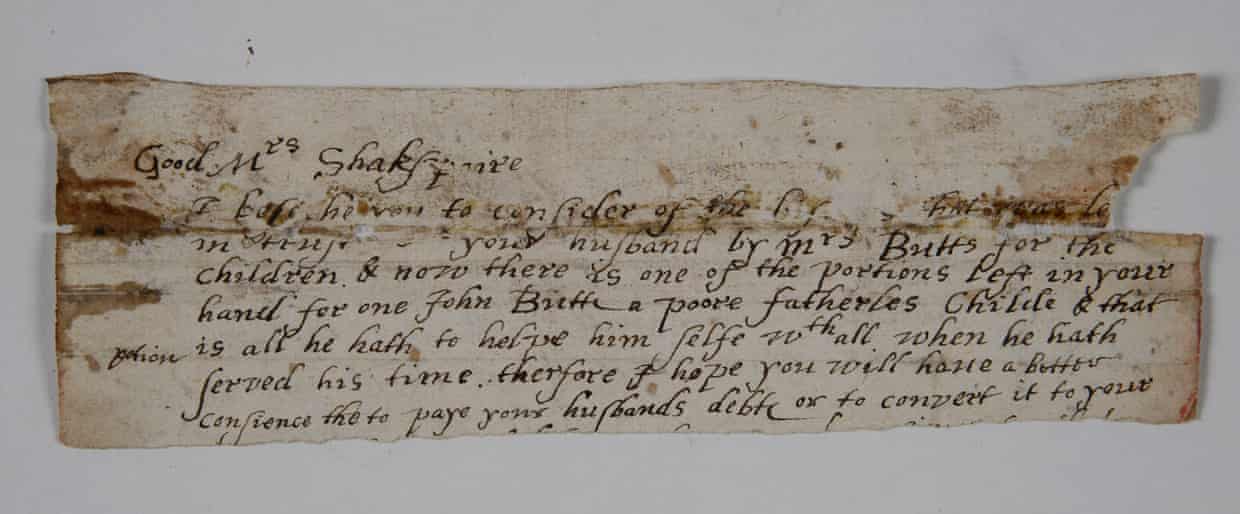

Shakespeare did not leave his wife Anne in Stratford, letter fragment suggests

Jimmy Kimmel on the pope’s death: ‘Now we know JD Vance is bad at praying, too’

‘Be playful, try new things!’ The Southbank Centre’s Mark Ball on his new festival, Multitudes

Celebrities pay tribute to Pope Francis: ‘Thank you for being an ally’

Post your questions for Nigel Havers